Paypal vs Stripe Comparison. Why & What to Choose?

READ WHOLE ARTICLE

PayPal and Stripe are renowned tools widely used for recurring payments. There are many payment systems out there, but these two have grown to cover the lion’s share of the market and their growth doesn’t seem to slow down. Picking a certain solution is a very individual case, but we can say for sure that while experienced users stay true to tried-and-tested solutions, new, ambitious, and, especially, young people are more likely to choose modern and innovative platforms.

Using Stripe and PayPal also helps easily solve a wide range of tasks. If you bought something online, chances are good that the payment was processed by one of these systems. They are similar in essence, but there are still principal differences. If you are not sure which of these payment gateways is optimal for your business, we’re here to figure out the best way how to choose a payment processor.

Let’s analyze the PayPal vs Stripe stand and who offers what. But for starters, we need to go through a bunch specifics to clarify the question – how is Stripe different from PayPal?

What is the Difference Between Stripe & PayPal?

To objectively compare Stripe to PayPal, keep in mind that PayPal is an integrated online solution that helps process payments and transfer money through the web. A large number of interconnected products processed by this engine, from simple mobile payments to various financial services, makes it a well-known and tested solution for all consumer layers.

According to official figures, PayPal has over 250 million registered customer accounts and is used by more than 20 million merchants, which makes it one of the most recognizable eCommerce tools.

The system proved to be successful and dominated online trading for a long time until Stripe appeared and set the goal of making the market ultimately consumer-centric.

Stripe is a relatively new online payment service based on a cloud platform. While it is not too widely used, its popularity is growing rapidly. Stripe is especially popular with code-savvy personalities and in-house programmers for its highly customizable tools. It is an alternative choice for small businesses but is also heavily used by big companies like Pinterest, Lyft, Blue Apron, and TaskRabbit.

Now, let’s into a bit more detail of comparing PayPal with Stripe.

Products & Services

Both platforms are reliable, efficient, and feature-rich. Looking at the capabilities of each service, it is worth considering that when it comes to Stripe vs PayPal for business and for regular customer-side use, each works a little differently.

The main task – payment processing – is handled end-to-end by both systems. But the PayPal customer is enabled to make payments using their own balance or credit/debit card. On top of that, there are also some extra services going far beyond sales only.

PayPal offers 3 service plans:

- Express Checkout

- Payments Standard

- Payments Pro

Extra services include:

- PayPal Here

- POS integration

- Virtual terminal

- PayFlow gateway

- Checkout page

- PCI compliance

- Online newsletter

- Digital products

- Subscriptions

- Donation raising tools

- “Buy now” buttons

- Mass Payments

- PayPal Credit

The service also offers SDKs and other tools to enable custom integrations and even applications to be supported on modern mobile platforms.

Stripe has a bit more features for customization, such as:

- Payment page

- PCI compliance

- Subscriptions

- Customizable payments

- Customizable reporting

- Trading tools

- Platform tools

- Coupons

- “Buy now” buttons

Stripe offers over a hundred features, including Atlas – a set of tools to help you easier start an international business. A robust API provides simple integration with a whole lot of other applications, including those supported by Android and iOS devices.

Another unique tool is Sigma. This is Stripe’s simple yet very robust reporting management tool. PayPal generates reports too, but only Stripe allows you to create your own custom SQL queries. The service has some of the most advanced order and subscription management tools.

PayPal has its robust subscription account management tools but doesn’t provide basic management. In this aspect, Stripe takes the cake.

Fees & Rates

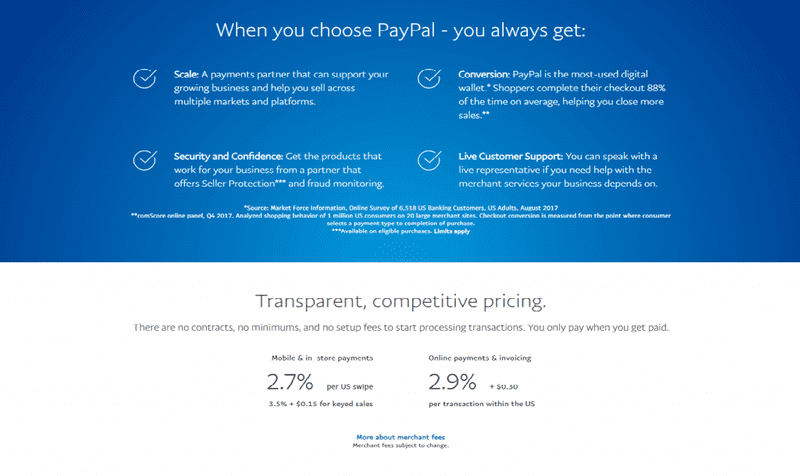

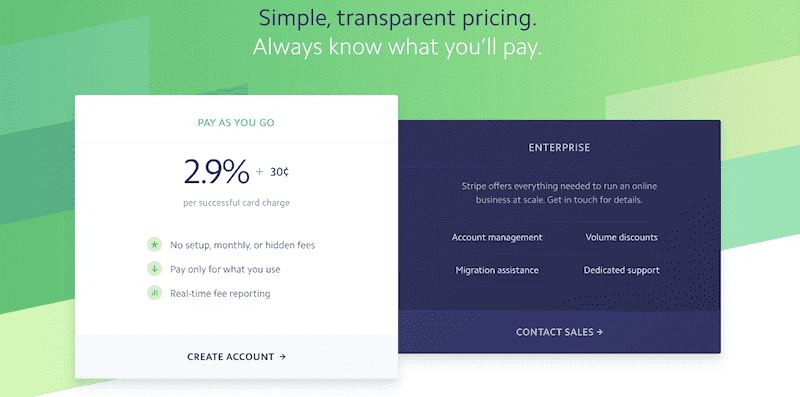

Choosing Stripe or PayPal, you may rest assured that both services are very transparent about fees, which is one of the reasons why they are leaders in the online payments industry. Both offer plans with no setup costs, base monthly fees, or contracts. However, PayPal’s list of implementations as a third-party processor is much wider and includes not only American companies.

Stripe vs PayPal payments

The services offer payments with the same commission ─ 2.9% + $0.30 per transaction. Stripe supports both ACH and Bitcoin with 0.8% fees that don’t go beyond $5. The platform doesn’t charge anything for the subscription and maintenance of international cards. However, if Connect is used, additional fees apply. At the same time, PayPal guarantees more transparent pricing.

Stripe vs PayPal fees rates

The basic PayPal subscription is free by default. Long-time regular service use is charged, however. Becoming a regular user, you also get a virtual payment terminal.

To start the regular use, you need to upgrade the plan:

- PayPal Pro: $30 per month

- Virtual terminal price: 3,1% + $0,30

- American Express fees in the Pro version with a virtual terminal: 3,5%

- Fixed payment: $10 per month

In all fairness, PayPal seems to be more cost-efficient. Comparing Stripe vs PayPal for nonprofits – it’s a combat draw. Both companies guarantee non-commercial discounts that reduce transaction fees to 2.2% + 30 cents.

When it comes to selling inexpensive goods (under $10 on average), PayPal offers a micro payment plan that can help lower expenses. You can pay 5% + $0.05 per transaction and since the fees are lower, you can save even with a higher interest rate. If you need mPOS, PayPal will come in cheaper – 2.7% versus 2.9% + $0.30 for Stripe.

So in both cases, your business is eligible for a lower price if you achieve a certain number of monthly sales. Stripe commissions drop at $80,000 worth of monthly sales while PayPal becomes cheaper at significantly lower sales volumes, starting at $3,000 per month.

Stripe also charges a $15 chargeback fee and PayPal charges $20.

Source image: pressidium.com

Ease of Use

PayPal offers simple tools. All you need to make a payment is an email address and password, as well as proof of payment details.

Configuring Stripe is very difficult without coding experience. Most likely, you will be able to handle the basic settings. But if you need to adjust something more complex, you will have to hire a developer.

To integrate the “Buy now” button, you just need to copy the code from the PayPal website and paste it into your project. Enabling a “Pay with Card” feature in Stripe, however, requires some more special knowledge.

PayPal supports two types of payments:

- direct ─ the platform charges a certain amount that goes to your affiliate’s linked account. All commissions are paid by the linked account and the platform itself charges a fixed percentage;

- target ─ commissions are compensated by the platform and assets’ worth is stored in your account. The money is transferred to your Stripe account and then automatically sent to the target party.

This variability gives you more options. If you are far from modern technology, a more reasonable option is PayPal because it is easier to use. But if you’re a developer, definitely check out Stripe. By and large, it’s safe to say that there is no winner in this round of the PayPal versus Stripe duel. Both services are good in their own way and each is unique.

Contract Length & Cancellation Fee

Everything is identical in both solutions here. Both services are paid on demand, which means that there is no contract and, accordingly, no fee for its early termination whatsoever.

Countries

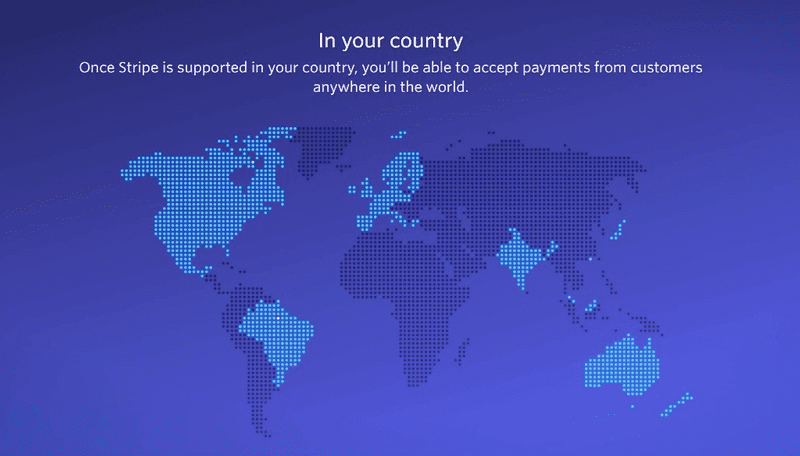

Unfortunately, PayPal only supports English. Stripe supports six languages, but as a payment service provider, it is still available only in 26 countries: the USA, UK, Australia, Canada, Brazil, India, Japan, and almost all European countries.

However, Stripe offers a workaround. No matter where you are, you can use Atlas to register a US company, open a US bank account, and get started. If you have a merchant account, you can pay from any country. Stripe supports over 135 different currencies. That’s more than PayPal can do (25).

Source image: stripe.com

PayPal’s geography is much wider – over 200 countries, so in this nomination it is a clear favorite. Regardless of where your company is registered, you can freely create a PayPal account.

What’s Better – Stripe or PayPal Integration?

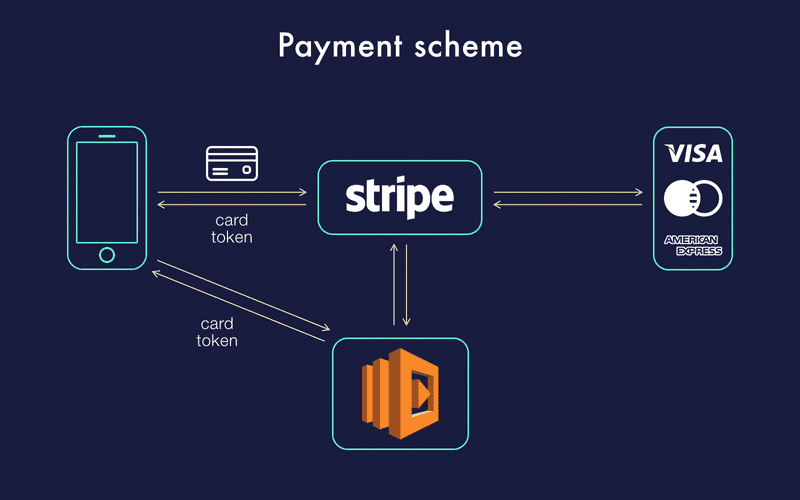

Stripe integrates with almost all existing commercial apps (eCommerce platforms, like WooCommerce, accounting systems, etc.). From direct integration with card networks and banks to browser plugin-powered payments, Stripe works and optimizes all levels of the financial stack.

The platform directly connects to Visa, Mastercard, American Express, Discover, JCB, and China UnionPay in global markets. Stripe Issuing, the first self-service card issuing API, is available to all US businesses.

Stripe works seamlessly with products like Ronin, Invite Robot. Taxamo, Attribution, Sage Business Cloud, Amex Express Checkout, APIGUM.

Source image: cleveroad.com

PayPal conveniently integrates with systems like Shopify, 123 Contact Form, Gravity Forms, Wild Apricot, Formsite, Formstack, Bookeo, WooCommerce, Magento, and IgnitionDeck. The choice is decent, so when it comes to Stripe and PayPal integration, both options are pretty versatile.

Sales & Advertising Transparency

Both platforms have great protection. Companies work honestly, openly, and are focused on not letting any fraudulent tricks or schemes pass. Everybody values their reputation so there no hidden costs or pitfalls. Both systems are well known, so there is no need for them to spam the web and annoy customers with excessive intrusive advertising.

Source image: wpbuffs.com

Customer Service & Support

The utmost attention is paid to customer service in both companies. Users can contact all-around available support with any questions at the most convenient time. There are no particular complaints about the response speed in each of the services.

PayPal support offers:

- Help Center

- Community forum

- Email support

- Developers’ Center

- Phone support (Mon-Fri from 5:00 to 10:00 PST ─ Pacific Standard Time)

- Support on social media: Twitter – @AskPayPal (serves Mon-Fri 9:00 am – 5:00 pm CST ─ Central Standard Time) and Facebook – you can’t place posts on the page, but you can comment on their publications and send PayPal messages.

Stripe support:

- Knowledge Database

- Email support

- Developer documentation

- Support via chat

- Support on social media: Facebook (comments are not allowed, but you can post) and Twitter ─ there is no separate account, but it is possible to check for update notifications (at @StripeStatus).

PayPal support helps to figure out any questions by phone. This doesn’t mean that Stripe support works worse than PayPal, but live communication is always best. Although, Stripe service is not far behind and has recently introduced free 24/7 live support for all sellers.

However, experts believe that PayPal support is better implemented. If you haven’t received your order or it has arrived damaged and you cannot resolve the problem with the seller directly, you can simply enable Buyer Protection. The service will check the transaction from start to finish, and if your claims are justified, you will get your money back.

Shopify Payment Gateways For Your Online Store

Conclusion

All in all, it’s difficult to say if there’s a definite leader in this race. Stripe is great. If you’re a developer looking to integrate a payment gateway with your app or website, this is definitely the right choice. Apart from technical nuances, when it comes to the Stripe vs PayPal fees rates comparison, neither makes you go bankrupt or anything.

Ultimately, choosing a payment gateway, you need to focus on real needs. If you want to accept payments through your eCommerce site, Stripe is a great solution, although you’ll need to put in a separate effort to integrate it with the system you use (like WooCommerce).

Since it is a fully integrated service, several previously disparate, low-tech processes are combined into one package. Stripe stays customizable and engineer-focused while PayPal focuses on being closer to simple consumers. If we juxtapose Stripe vs PayPal payments, it turns out that Stripe works better with Shopify and other major marketplaces, as well as tech-savvy companies.

Looking from a different perspective, PayPal has a lot to offer to small businesses. If you decide to expand your regular business into an online store, the simpler payment method is more profitable. Moreover, no specialist is required for setup. If you’re interested in a branding checkout for your site, try Stripe.

A service without basic or installation fees will be optimal for you as well. If you’re already working with an existing merchant account and want to use it to process online payments, then the fair fight of Stripe vs PayPal is clearly won by the latter.

36 Kings Road

CM1 4HP Chelmsford

England